How to File Your Taxes for Free with Direct File: A Step-by-Step Guide

Key Takeaways

- Direct File is a significant stride towards simplifying tax filing, making it more accessible and less burdensome for eligible taxpayers.

- Eligibility is currently confined to residents of 12 pilot states, with specific income types and tax situations.

- The platform is designed to be user-friendly, with support available in English and Spanish, ensuring a broad range of taxpayers can benefit from this free service.

Introduction

In an era where the complexity of tax filing often leaves taxpayers bewildered and financially strained, the Internal Revenue Service (IRS) has launched an initiative that promises to simplify this annual chore while eliminating cost barriers.

Introducing Direct File, a groundbreaking tool designed to enable eligible taxpayers to file their federal taxes directly through the IRS at no charge. This innovative approach not only represents a significant shift towards making tax filing more accessible but also underscores the government’s commitment to leveraging technology for the public good.

Eligibility Criteria for Direct File

To ensure a smooth transition to this new system, Direct File’s availability is initially limited to residents of 12 pilot states: Arizona (AZ), California (CA), Florida (FL), Massachusetts (MA), New Hampshire (NH), Nevada (NV), New York (NY), South Dakota (SD), Tennessee (TN), Texas (TX), Washington (WA), and Wyoming (WY). Furthermore, eligibility hinges on specific income types and tax filing statuses:

- Income Types Accepted: W-2, 1099-G, SSA-1099, and 1099-INT.

- Deduction Restrictions: Only the standard deduction is allowable.

- Tax Credits: Eligibility for Child Tax Credit, Earned Income Tax Credit, and Credit for Other Dependents.

- Insurance and Health Savings Account (HSA) Limitations: Ineligibility for those who purchased health insurance directly or have withdrawn from an HSA.

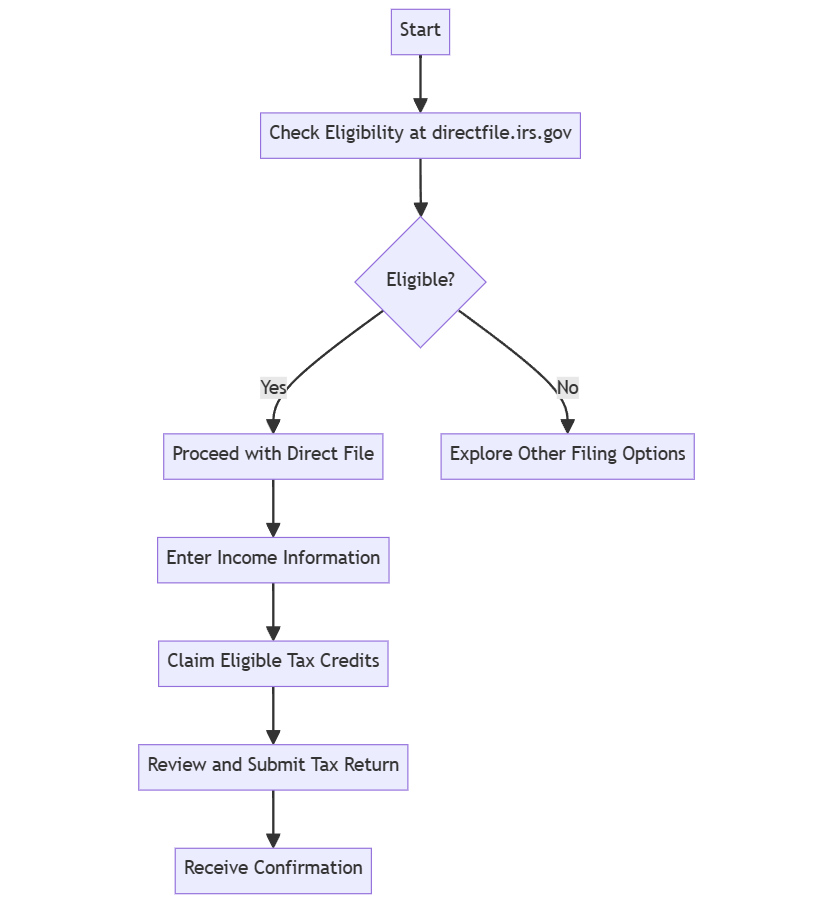

Accessing and Using Direct File

Direct File stands out for its user-centric design, offering services in both English and Spanish, complemented by chat support to navigate users through the filing process. The platform is equipped with an eligibility checking tool, ensuring taxpayers can verify their qualification before proceeding. Interested individuals can explore this tool by visiting directfile.irs.gov.

Why Direct File Matters

The introduction of Direct File marks a pivotal moment in tax administration, aimed at reducing the time and financial burdens traditionally associated with tax filing. By offering a direct, free-of-charge conduit to the IRS, this tool not only streamlines the filing process but also challenges the status quo, encouraging a reevaluation of tax filing services and their associated costs.

FAQs

Q: Can anyone use Direct File? A: Currently, it’s available to taxpayers in select states with specific types of income and tax situations.

Q: Is there a cost to use Direct File? A: No, Direct File is a free service provided by the IRS.

Q: How do I know if I’m eligible for Direct File? A: Visit directfile.irs.gov and use the eligibility checking tool.

Talk Resumes with Wealth Waggle

Perfect your resume with AI-assisted feedback and tips (using the latest recruiting intelligence).